Rising Bitcoin Exchange Deposits Spark Worries Over Possible Sell-Off

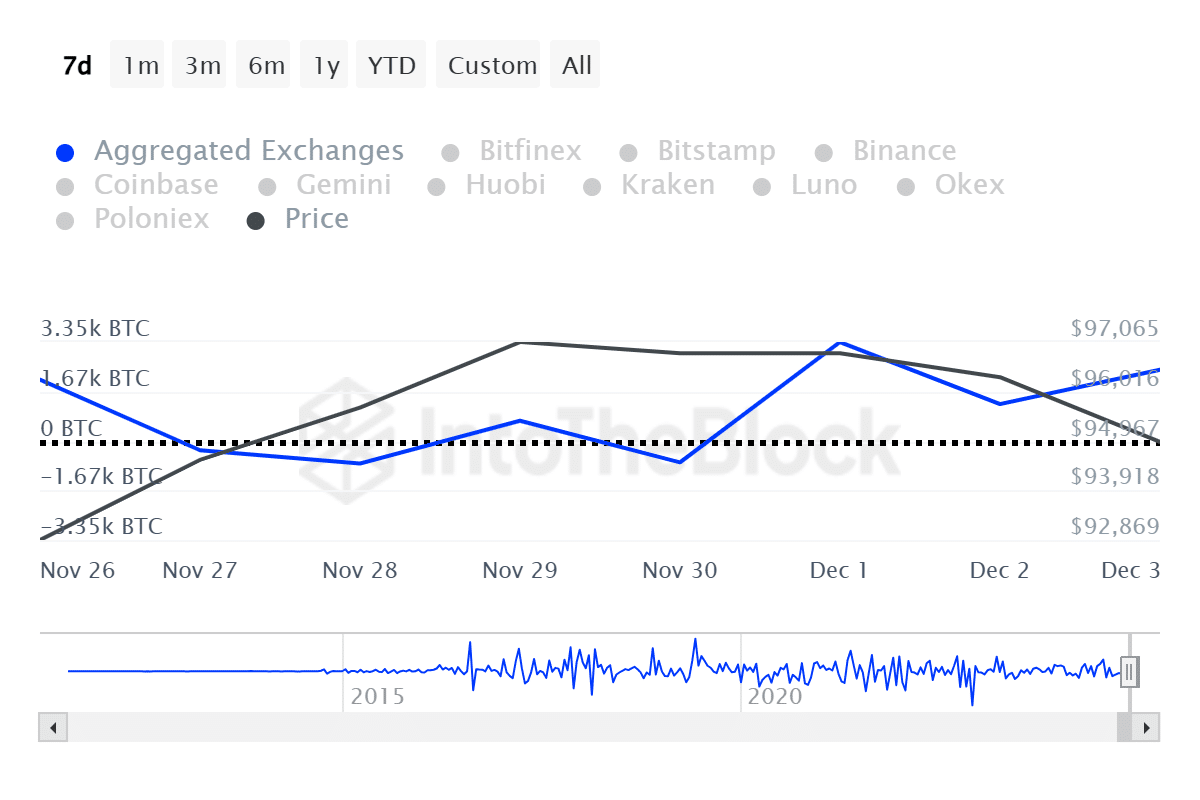

Starting December 1, Bitcoin has seen a significant increase in inflows to centralized exchanges, sparking worries about a possible selloff.

According to data from IntoTheBlock, the net flows of Bitcoin (BTC) on exchanges surged, moving from a net outflow of $69 million to a net inflow of $326 million. Remarkably, the cryptocurrency experienced a net inflow of $230 million on December 3.

In total, centralized exchange platforms saw over $562 million worth of Bitcoin move in, as per ITB data.

Moreover, the ratio of large holder-to-exchange net flow for Bitcoin rose to 0.86% on Tuesday, signaling that Bitcoin whales are more engaged than retail investors, based on ITB data.

The analytics platform also noted an uptick in large Bitcoin transactions, defined as those exceeding $100,000, which increased from 17,960 to 25,830 during the same timeframe as the exchange net flows.

On Monday, December 2, the volume of these large transactions soared from $38.7 billion to $87.3 billion in BTC. Over the past week, Bitcoin recorded $169.6 billion in whale transactions, as per ITB’s report.

On-chain data indicates that a long-term whale address, holding 2,700 BTC valued at over $257 million, relocated its Bitcoin for the first time since December 2013, suggesting a possible selloff after a remarkable 157-fold return.

This whale initially purchased the Bitcoins when prices were around $625, resulting in a total investment of $1.68 million.

Currently, Bitcoin is trading at $96,500, with a 1% increase over the last day. Its market capitalization has once again exceeded $1.9 trillion.

The rise in exchange inflows may instill fear, uncertainty, and doubt (FUD) among retail investors; however, heightened whale accumulation could shift market sentiment and drive buying pressure.

At this point, a significant bullish trigger for Bitcoin and altcoins could be an anticipated rate cut by the U.S. Federal Reserve, with the FOMC meeting set for December 17 and 18.

Disclosure: This article is not intended as investment advice. The information and materials provided on this page are for educational purposes only.